The Mandrake Mechanism: How the Fed Prints Money (and Who Profits)

We’re going to take a brief pause on our The Central Banks educational series and go into an absolutely fascinating discussion. It really gets to the heart of what Central Banking does, and the deeper you go down this rabbit hole, the more horrified you become. It’s like Alice in Wonderland, except Wonderland is this bizarre world (more bizarre than Wonderland) where nobody actually understands how this stuff functions. But once you grasp it … wow.

First of all, a little-known fact that’s important to start with: Did you know that the Federal Reserve is not actually an agency of the US Government? I know—crazy. But you must start with this premise to grasp this situation's wildness. The Federal Reserve System is governed by a Board of Governors, but the 12 regional Reserve Banks—which hold and move the money—are quasi-private entities owned by commercial banks in their regions. These member banks receive dividends, appoint directors, and shape monetary policy from the inside.

Could you let that sink in? The Federal Reserve is controlled by private banking interests.

It is not “Federal” at all (clever name choice, though - you have to hand it to “them”).

It’s a massive, private bank that exists to serve the interests of its “owners,” which are major Wall Street and corporate interests. The owners of the constituent banks are paid annual dividends from the Federal Reserve. Think about that.

People are profiting from the Federal Reserve. Read until the end to understand this situation's absolute travesty.

Okay - let’s move on.

The Mandrake Mechanism

If you haven’t read it, the book is one-part monetary history, one-part political thriller. And even if you disagree with its conclusions, you’ll never look at the Fed the same way again.

Mandrake the Magician is a historical character who could supposedly ‘create things from nothing.’ Another way to think about the “Mandrake Mechanism” is to say that our ages-long quest to transmute lead to gold seems to have finally found its perfection in modern-day central banking.

Here is, in short, the way that our modern banking system works.

Step 1: Open Market Operations

If the Fed decides to increase the amount of money circulating in the system, it will commence what’s called an Open Market Operation.

Succinctly, this means that if JP Morgan owns $1 billion of treasury debt, the Fed will buy this back from JP Morgan and deposit $1 billion in cash in JP Morgan’s vaults. Except - critical point - the Fed didn’t have $1 billion in cash to make this transaction. What it did was create the money out of thin air.

Think about that from the perspective of the steady devaluation of fiat currency. The Fed can (and often does) print money to acquire bonds from banks and inject liquidity into the system.

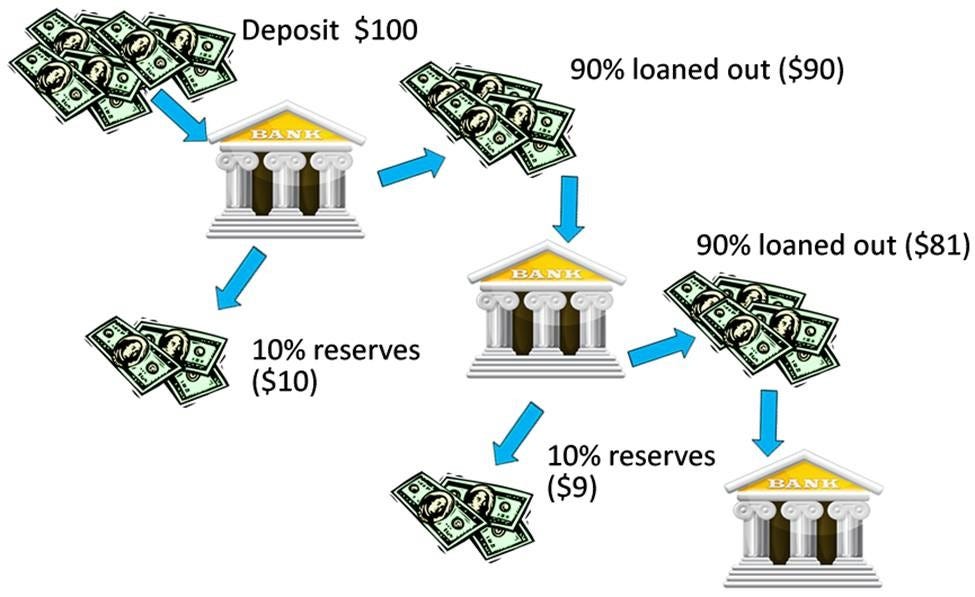

Step 2: Fractional Reserve Banking

Then, we dive into the heart of how fractional reserve banking works. You see, JP Morgan now has $1 billion in reserves. Banks will never “sit on that money” and do nothing with it. They are morally bound to lend it.

So they do lend it. But they don’t have to keep it all in reserves. Their “reserve ratio” might be 10%. This means that they can lend $900 million out and keep only $100 million in reserves.

The consumer who received the $900 million loan will go and spend it, and the person who receives that money will, in turn, deposit that money into their bank account. That bank will then withhold 10% of that money and loan out 90% of that money, and so on and so forth.

Some Implications

The "core implication” of this entire system is that our entire fiat currency system is based on debt. Every dollar we own or have is based on somebody else’s debt.

The negatives of this system are profound.

First, what multiplies upwards (credit growth, money growth) can also swiftly contract. This means that the economy booms when things are going well, and money growth and lending are good. But in a downturn, it can very swiftly contract and cause widespread economic pain.

This means that the Fed needs to get involved and try to save the day from something it created.

It promotes huge boom and bust cycles, in other words, and a constant pressure to devalue our currency.

A Few Other Thoughts

So what happens when the US Government needs money?

There are two primary sources of “cash” for the government: taxes and borrowing. As anybody knows, if you spend more than you make in personal finance, you fund that excess spending with debt. Eventually, that doesn’t work anymore.

Here’s the wild thing. The US Government has a “buyer of last resort” for its debt. The Fed can (and does) simply create money to buy from the US Government, depositing cash in its coffers.

For instance, in 2020 - 2021, the US Government ran up a huge deficit to fund spending it had in mind. There was inadequate interest from the private market for the debt, so the Federal Reserve stepped in, created money, and bought those bonds from the US Government, injecting trillions into the ecosystem.

Do you think today’s inflation came from nowhere?

This action will inevitably create issues - as we saw. Yes, there were other reasons for the inflation as well (in my opinion), but it is an inevitable conclusion that massively printing money into the system will cause inflation.

Why this entire situation is horrifying

I want to finish this piece with a really amazing observation.

I mentioned before that the Fed is basically privately owned.

So, how does the Fed make money for its members?

Okay - buckle up.

It makes almost all of its money from the interest income it earns on the bonds it purchases. And remember - please remember - that the owners of the Fed (the banks and private Wall Street interests) are paid dividends from this operation.

In 2022 the Fed earned $150 billion in interest.

But here’s the thing. It bought those bonds (that earn it interest) by creating money out of thin air.

In other words - how would you feel about earning an enormous amount of interest income from bonds you bought with money you invented in your basement?

It would feel pretty amazing.

The scale of this system is absolutely insane. I don’t think people fully recognize how insane it is. And yet, that’s the system we live in, and our lives are dictated by it.

The Mandrake Mechanism isn’t some tinfoil myth. It’s how the system works. And if you want to understand money, power, inflation—and yes, real estate—this is the hidden engine behind it all.

Join my private newsletter (in addition to this Substack) for more informal commentary from me via email.