The Illusion of Stability: Why Financial Models Often Fail

Let’s talk about something that plagues financial modeling, forecasting, and honestly, most human decision-making: the assumption of stability.

You’ve seen it. It’s baked into nearly every projection you’ve read this year. Whether it’s GDP growth, inflation, interest rates, or equity markets, forecasts always come with this underlying belief that the world is just going to keep humming along “normally.” Nothing too wild. Nothing unexpected. A nice, clean line from Point A to Point B.

There’s a good reason for this. We must assume stability—because historically, it’s the only way to plan for anything. If the sun didn’t shine in summertime, crops wouldn’t grow. Without stability, we’d struggle to survive, much less build and plan for the future.

I’ve been watching this new show, The Three-Body Problem (by the Game of Thrones creators), and it’s a fascinating exploration of what happens in a world where stability doesn’t exist. Imagine a planetary system where weather patterns and even sunlight were completely unpredictable. Disaster is the quick answer. Over and over again.

But here’s the uncomfortable truth: stability is an illusion, even in our world with only one sun. And worse, we love to believe in it, despite all evidence to the contrary.

The Problem With Stability Assumptions

Here’s how it goes:

- The model takes historical data and projects it into the future.

- The result? A tidy prediction that assumes “the future will rhyme with the past.”

- The reality? The future laughs at those assumptions.

Financial models don’t fail because they’re poorly designed. They fail because they’re built on human tendencies—biases, blind spots, and our love for patterns. We assume stability because stability feels safe. It feels predictable. And who doesn’t love a nice, predictable world?

History’s Favorite Hobby: Destroying Stability Assumptions

If you’ve spent more than five minutes in the financial world, you already know: the biggest market moves come from the stuff no one sees coming. Let’s take a walk down memory lane:

-

2008 Financial Crisis:

Remember when everyone thought real estate prices couldn’t go down? The assumption of stability was the foundation of every model, every mortgage-backed security, and every rosy economic outlook. That stability turned out to be quicksand.

-

COVID-19 Pandemic (2020):

Find me a financial model that accounted for a global pandemic shutting down the economy overnight. Spoiler: it didn’t exist. Models built on historical trends couldn’t predict a once-in-a-century disruption.

-

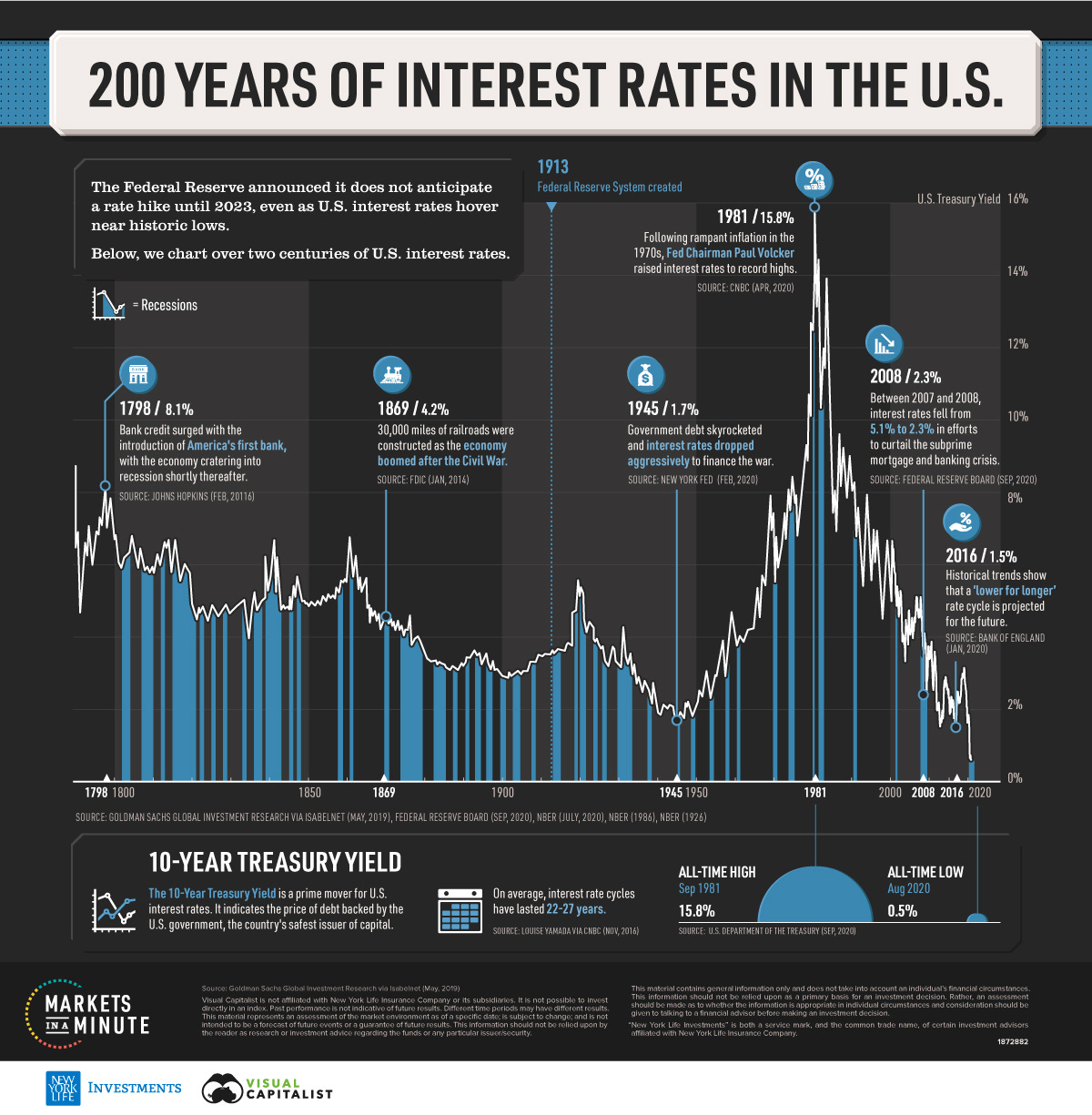

Interest Rates (2023-2024):

“Transitory inflation,” they said. “Rates will come back down quickly,” they said. And now here we are, living in a “higher for longer” world that most forecasts didn’t even consider.

-

Real Estate Rent Increases over the past few years:

Another one that a lot of industry practitioners fell prey to was the assumption of ever-rising rental rates for apartments. I think this was particularly dangerous in the Sunbelt and the South-east markets. Sponsors investing in Texas, for instance, assumed stability or growth in their markets to their chagrin now. By the way - it's not just them - we all do this. Nobody underwrites a deal assuming highly volatile or decreasing rents - we usually trend upwards.

Why Do We Cling to Stability?

You’d think we’d learn by now. But no, we keep going back to the same playbook. Why? Because humans are wired to believe in stability. It’s comforting. It’s safe. And it keeps us from confronting just how unpredictable the world really is.

Here’s why we fall into this trap:

-

Cognitive Bias:

Our brains are pattern-seeking machines. We want to believe the future will behave like the past because it’s easier to process. Stability feels logical. Chaos doesn’t. -

Career Risk:

Let’s be honest—no one wants to be the outlier. If you make a bold prediction and you’re wrong, you might lose your job. But if you’re wrong with the crowd, it’s fine. Better to be safely mediocre than boldly wrong. -

Data Dependency:

Models rely on historical data. And if that data is stable, the model assumes the future will be, too. But the world isn’t data—it’s human behavior, geopolitics, and black swan events that don’t fit neatly into a spreadsheet.

What’s the Fix?

We can’t predict the future perfectly (if you can, let me know—I’ll happily invest in your crystal ball). But we can build better frameworks for thinking about it. Here’s how:

-

Test the Extremes:

Forget the “most likely” scenario. What happens if inflation doesn’t cool? What happens if rates drop faster than anyone expects? Stress-test your assumptions against the wild cards. -

Embrace Uncertainty:

The future isn’t stable, and that’s okay. Build flexibility into your models. Assume things will change—because they will. -

Think Beyond the Spreadsheet:

Real life doesn’t fit into tidy rows and columns. Markets are driven by people, politics, and events no one can foresee. A model can’t predict war, pandemics, or revolutions in technology—but you can at least account for the possibility of disruption.

A Thought Experiment

Let’s say you’re reading a 2025 projection. It says rates will stabilize, inflation will cool, and equity markets will deliver “modest growth.” Sounds nice, right? But here’s the question you should always ask:

What happens if they’re wrong?

What if inflation spikes? What if rates go higher instead of lower? What if the geopolitical situation deteriorates? What if the market doesn’t do “modest growth” and instead rallies hard—or tanks just as hard?

The lesson here isn’t to reject forecasts outright. It’s to understand their limitations. To ask the uncomfortable questions. To be ready for the scenarios no one else is considering.

Stability Is the Exception, Not the Rule

If history teaches us anything, it’s this: change is the only constant. The world isn’t stable. Markets aren’t stable. Stability is a temporary illusion, and the sooner we stop clinging to it, the better equipped we’ll be to navigate what’s ahead.

So the next time you’re looking at a projection, don’t get too comfortable. The future has a way of surprising us—and that’s where the real opportunities lie.