The Chaos Factor

Entropy in Investing: Turning Chaos into Opportunity

In physics, entropy measures the universe's tendency toward disorder. In investing, entropy feels like waking up to unexpected market volatility, a sudden spike in interest rates, or a property deal that derails due to factors beyond your control. But what if this chaos wasn’t just inevitable - what if it could be leveraged to your advantage?

I’ve come to believe that investing is inherently entropic (chaotic). Markets, economies, and even individual deals are constantly moving toward disorder. What holds true in physics - the universe tends towards disorder - also holds true in investing. Success isn’t about eliminating entropy. You can’t. I've come to the conclusion that investing, and life, is about accepting that disorder exists and planning for it. And in many cases - using it to your advantage.

Allow me to wax philosophical for a moment. We humans crave order. We look for order in an inherently disorderly universe. There is probably an order there, somewhere, but it's beyond our vision. And we need order because we rely upon it to survive - we rely upon the sun to rise each day, we rely upon Spring to arrive in order to plant our crops and feed our children.

We look for signs of order in matters of day-to-day vital importance. Health. Money. Relationships. We extrapolate "order" out of "disorder" in order for our minds to feel safe, and because it is crucial to our survival. But in investing this is a trap.

There is no order. Things are inherently chaotic by their very nature - and when something appears very organized, it is likely a fortuitous string of events.

But you can - in fact - build disorder into your system and plan for it. This, then, will give the appearance of order to you, your investors, and your family.

What Does Entropy Look Like in Investing?

All investing is prone to chaos. Things can go wrong - and do - all the time. With the stock market, this levels out over time with the notion that "over time" the market will eventually go up. So even though markets are disorderly in the short-term, they are in fact orderly in the long run.

Real estate, while exhibiting the same characteristic (over time, it goes up in value, and the longer you hold the more certain the outcome), is much more prone to chaos in the short-term. There's a couple reasons for this. I think the chief amongst them is that in real estate the chaotic things that happen in the short-run require much more attention, because by its nature real estate is a much more "active" asset class.

In other words - the stock market self-corrects over time. Issues in real estate require the active hand of the ownership to resolve it - meaning you are dealing, nearly daily, with the chaos factor.

Real Estate also operates on long timelines and interacts with countless unpredictable variables. A project that looks perfect on paper today could be a headache tomorrow due to shifts in tenant preferences, regulatory hurdles, or supply chain delays. Even stabilized assets aren’t immune—ask any investor whose insurance premiums have skyrocketed in the last year.

Why Chaos Reigns Supreme in Real Estate

Real estate is often perceived as a stable, reliable investment. And while that’s true over long time horizons, the reality is that the day-to-day is anything but stable. Here’s why:

-

Long Timelines: Projects often take years to execute, and markets can shift dramatically during that time.

-

External Forces: Real estate doesn’t exist in a vacuum. Interest rates, labor costs, and even geopolitical events can influence outcomes.

-

Physical Assets: Unlike stocks or bonds, real estate comes with tangible risks—maintenance issues, natural disasters, or unforeseen repairs can disrupt cash flow and eat into returns.

An example: During Portland's last big winter storm, I knew of several brand-new buildings that experienced pipe freezes, bursts and flooding. Who would have guessed that 1910 vintage properties sailed through with no problems, and brand new assets would deal with this issue?

Perhaps the most "known" form of chaos in real estate, your management company. In-house or 3rd party, they are all prone to chaos over time. My observation as an investor now for nearly a decade - if you are not carefully managing the management company, it will not manage itself. Things will trend toward disorder. it's unfortunate, but it's true. The number of properties we have acquired with absentee ownership and failing management teams bears testament to this. It is a known opportunity in investing for a reason. You are capitalizing on the tendency towards chaos. Just don't be the victim of it.

Strategies for Managing Entropy in Investing

If entropy is unavoidable, the question becomes: How do you manage it? Here are three strategies that have worked for me:

1. Prepare for the Unpredictable

Liquidity is your best friend when entropy strikes. Deals that seemed rock-solid can fall apart due to unforeseen expenses or market shifts. Maintaining cash reserves allows you to weather these storms and capitalize on opportunities when others are forced to sell.

2. Systematize Your Approach

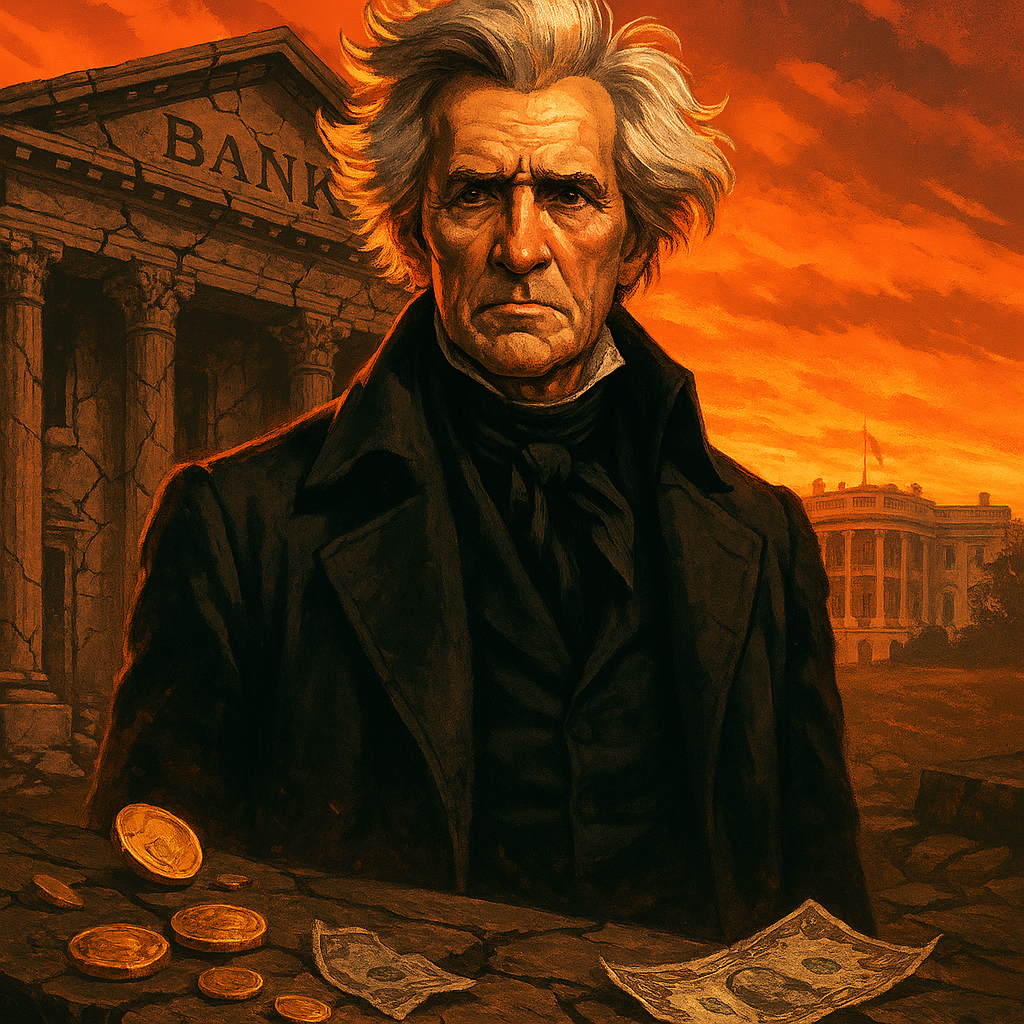

Great investors thrive in chaotic environments because they rely on systems, not gut instincts. Repeatable processes for underwriting deals, managing risk, and executing strategies create a framework that absorbs uncertainty. John Jacob Astor’s approach to leasing rather than selling his properties is a historical example of a system that stood the test of time, even during panics like 1837.

3. Capitalize on Chaos

Entropy creates opportunity. Rising interest rates may push cautious or overleveraged competitors out of the market, leaving room for disciplined investors to acquire assets at a discount. In the present period of rising interest rates and economic uncertainty (classic entropy in markets) there is an opportunity to acquire assets at fantastic prices. Some investors are making moves, others are not. But always - always - somebody is capitalizing on chaos to make money.

The Psychological Cost of Entropy

Managing entropy isn’t just about financial strategy; it’s about mindset. Here’s how entropy impacts decision-making:

-

Emotional Investing: Fear and greed amplify losses when investors overreact to volatility.

-

Decision Fatigue: Constant uncertainty can paralyze investors, leading to inaction or poor choices.

The antidote? Discipline and perspective. Entropy feels overwhelming in the short term, but measured across decades, it often turns out to be the catalyst for extraordinary returns. Staying calm, methodical, and focused on the long-term horizon can help you navigate the noise.

Personally, I find journaling to be a useful exercise in managing the day-to-day chaos. It gives perspective, allows you to step back from emotions, and manage yourself and the situation better.

Embracing Entropy in Real Estate

The most successful investors I’ve seen don’t fear entropy; they embrace it. They understand that disorder is where opportunity lives. Rising interest rates, shifting tenant demands, and even unexpected disasters all create openings for those who are prepared to act decisively.

In real estate, entropy isn’t the enemy. It’s the reality. And when you build systems, stay liquid, and approach the market with patience, you can turn chaos into your greatest advantage.

What’s been your experience with entropy in investing? Have market chaos or unexpected events opened doors for you—or closed them? Let me know in the comments. I’d love to hear your perspective.