Paradigm Shifts in Investing

It isn't a big stretch to say this recent period of history has been challenging for investors (of all stripes), but particularly for real estate investors. I often compare and contrast today to 2021. At the start of 2021 we were living in a world of permanently low inflation, and permanently low interest rates.

Today, by contrast, we have had above-trend inflation and rising interest rates. By itself, that's not really unusual. But what has been challenging is the Paradigm Shift that we've undergone. The paradigm investors worked in was of a world that was remarkably stable. You could acquire buildings with low debt, ride rent increases, and do a hugely successful cash out refinance with super cheap debt and enjoy the win.

An Old Paradigm Deal (that worked)

One of our first deals hit these markers exactly. I'll give the story, just because it's illustrative of how good things were. We acquired a 23-unit building here in Portland for $3.1 million. We invested money in renovating the units, redid the full exterior - it turned from something of a dump to a real gem. We even had neighbors (of a condo association) coming and thanking us for transforming the asset. It re-appraised 1 year later (at a 5% cap rate) for $5.1 million, and we executed a refinance that returned 60% of the investors initial equity on a 5 year loan at 3.1% fully amortizing.

Check these deal figures. Investor cash left in the deal was about $600,000. The building continued to cash flow. And on top of it, we were amortizing about $6.5k per month off the loan. A quick math check says the amortization alone was like a 12% effective yield on cash in the deal, not counting the equity appreciation already built in, plus the ongoing cash flow.

I like to think we were geniuses, but actually the deal also hit at the perfect timing. Today it's probably worth less than $5.1 (but still has a healthy gain from initial purchase). Investors are still amortizing $70-80k per year off the loan, and receiving cash flow. But the point is this - in an environment like we had, you could build a business plan off of that business model. That was our business plan at the time - long term ownership, supported by refinances, amortization, rinse and repeat.

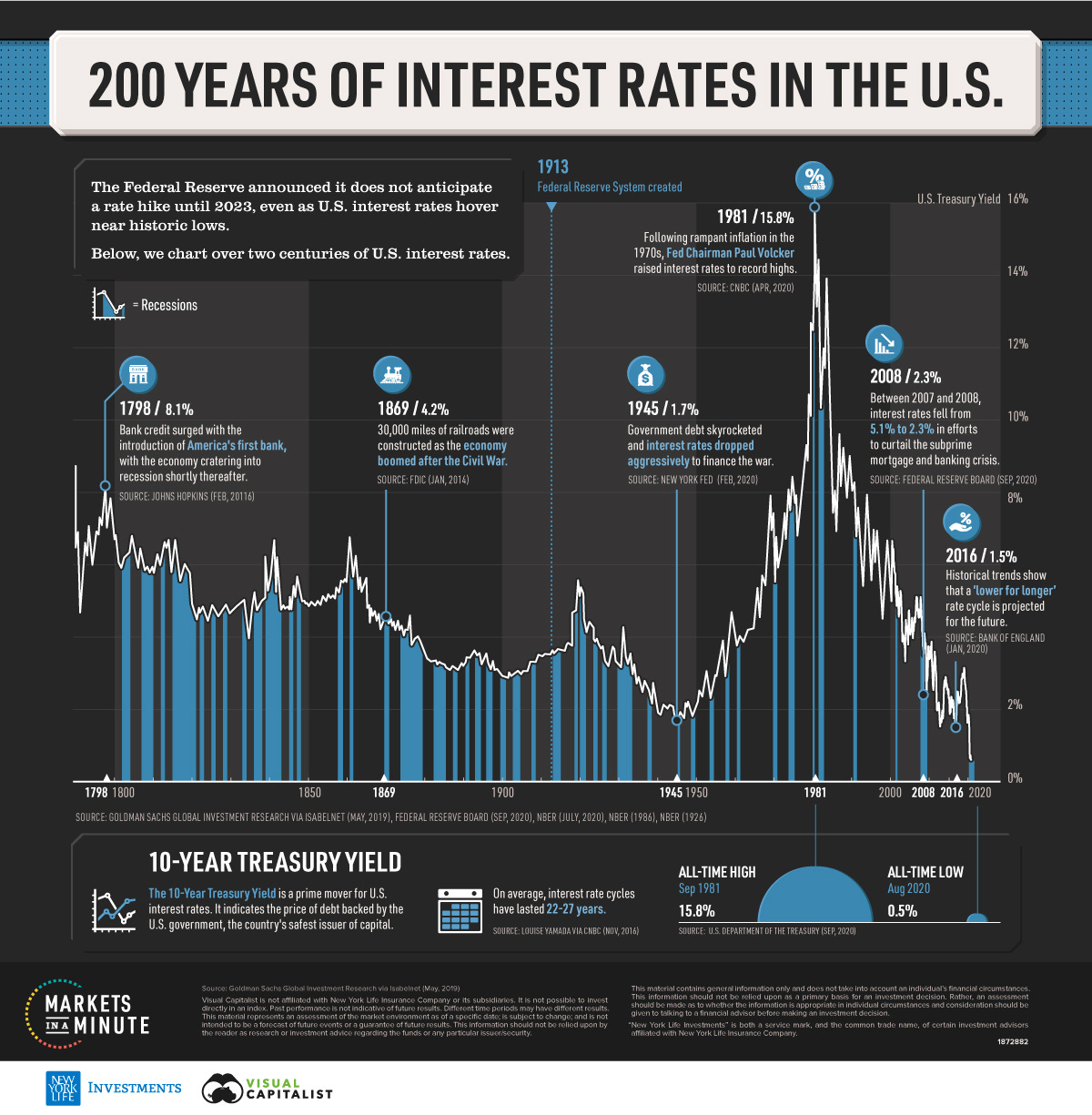

Then inflation raised its head, interest rates shot up, and suddenly the whole world went topsy-turvy. The issue I"m highlighting here is not that interest rates went up. It's that we had a complete paradigm shift, which challenged the way investors think about investing. The world had fundamentally changed. Not in a way we hadn't seen before, but in a way we hadn't seen for awhile and so it was challenging for investors to digest.

It certainly doesn't help that many sponsors, ourselves included, owned properties that were acquired before the shift. It required(s) a fundamental recalculation of asset values and how to invest. The world of stable interest rates supported by rising rents and juicy cash-out refinances was out (is out) for the time being.

As I referenced in an earlier post - we depend upon "stability" for models. But today's world doesn't feel stable. It feels like a fundamental shift.

Just because I studied history and like these things, here are a few other historic "Paradigm Shifts" that really challenged the way investors thought about the world.

The Shift Away from the Gold Standard (1971)

The decision by President Nixon in 1971 to abandon the U.S. dollar’s convertibility into gold was a seismic shift in the global economic system. For decades, the Bretton Woods system anchored currencies to the dollar, and the dollar, in turn, was backed by gold. This link created a sense of stability and predictability for investors. But as the U.S. faced inflationary pressures and a growing trade deficit, Nixon’s move severed the dollar’s ties to gold, effectively creating a fiat currency system.

This was a moment that forced investors to rethink the very foundation of value. Currency fluctuations became a new normal, inflation became a real concern, and central banks gained unprecedented influence over monetary policy. For real estate investors, the shift led to a renewed interest in hard assets—physical properties that could hedge against inflation in a world where paper money was no longer tied to something tangible.

The Great Depression and the Birth of Keynesian Economics (1930s)

The stock market crash of 1929 and the ensuing Great Depression created one of the most profound shifts in economic thought and investment strategy. Before the crash, most believed that markets were self-correcting and that minimal government interference was best for economic growth. The prolonged economic collapse shattered that belief, leading to the rise of Keynesian economics, which emphasized active government intervention to manage economic cycles.

For investors, this marked a dramatic change. Suddenly, the actions of governments—fiscal stimulus, deficit spending, and new monetary policies—became critical drivers of markets. Bonds and equities were no longer just reflections of corporate performance; they were also tied to government actions and policy decisions. This paradigm shift taught investors to watch not only markets but also the broader political and economic landscape.

The Volcker Shock and the Defeat of Inflation (1980s)

By the late 1970s, inflation had reached double digits, eroding purchasing power and throwing markets into chaos. Paul Volcker, as Chairman of the Federal Reserve, made the bold decision to hike interest rates to historically high levels to break the back of inflation. The move caused a severe recession in the early 1980s but succeeded in restoring price stability and resetting expectations.

The Volcker Shock forced investors to adapt to a world where central bank policy could drive recessions—or recoveries. It also marked the beginning of a decades-long period of declining interest rates and low inflation, which became the foundation for modern investment strategies. For real estate, the implications were profound: properties became more attractive as long-term inflation hedges, and the eventual decline in interest rates fueled an unprecedented bull market for leveraged assets.

Conclusion

Today, as we navigate another paradigm shift, the lessons from history are clear: successful investors are those who adapt quickly, rethink their strategies, and anticipate the implications of systemic changes. In a world of rising rates and inflation, the question isn’t whether to adapt—but how.

Sources

-

Macrotrends data source - 'https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart'>10

-

BLS Data Table - https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm