November 2024 Newsletter

November is behind us – a very happy Thanksgiving to all of you. We were thrilled to welcome the newest (and final!) addition to our family, bringing us to a bustling group of six (3 boys, 1 girl). Things are busy – but newsletters wait for no one (not even a newborn), and the good work must continue.

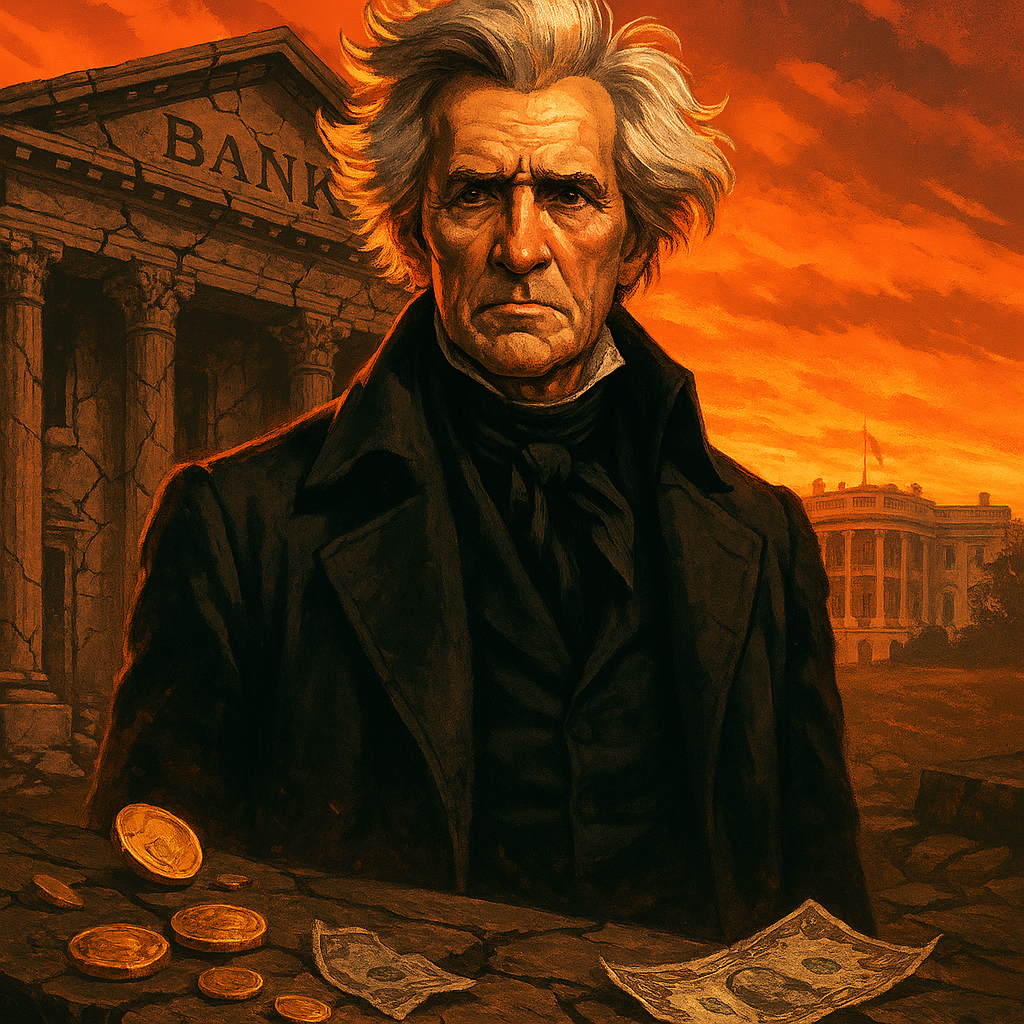

Beyond our personal family exploits – November was a momentous month. Donald J. Trump won the presidency in a decisive manner, which appears a bit less decisive now, but a win's a win in any case. In retrospect it seems evident that the Biden Administration would be punished by voters for the inflation we’ve experienced over the past few years – voters, ultimately, see the cost of their groceries rising a LOT and common-sense dictates that the party in power would be punished for it.

Partisans (on both sides) may claim other reasons for the victory, but at a basic level the average American family pays $225 - $275 more, per month, for groceries than they did January 2021, according to the U.S. Bureau of Labor Statistics Consumer Price Index (CPI) for Food at Home series. It's hard to argue that this doesn't color voter's perceptions of whoever is in charge at the time.

Lombard Equities' 2024 Finale: Grandview Apartments

On the business front, November marked a major milestone for Lombard Equities. We closed our final acquisition for 2024 with the addition of the Grandview Apartments to our portfolio. You can read our full write-up here. For those curious, here’s a nice image of the property. This is an “opportunistic cash flow” deal, acquired at a very low basis and designed from day one to deliver a double-digit cash yield to our equity investors.

Election Impacts: What a Trump Presidency Could Mean for Real Estate

Predicting the economic and market impact of a new presidency is always a challenge. Campaign promises often evolve into something quite different once governance begins, and the machinery of federal policy moves slowly. Still, we can glean a few early signals to anticipate potential shifts in the real estate and economic landscape.

Regulatory Environment: A Potential Reset

The incoming Trump administration has signaled a shift toward deregulation in housing markets. While terms like "significant" can often mean "incremental" in Washington, there are a few key areas to watch:

- AFFH Rollback: The administration is likely to scale back the Affirmatively Furthering Fair Housing (AFFH) rule, which required local governments to address housing segregation proactively. This could make zoning decisions more developer-friendly, with less federal oversight.

- Lending Standards: The Consumer Financial Protection Bureau (CFPB) is expected to reduce housing-related enforcement, potentially leading to relaxed lending standards. While this could mean increased liquidity and more flexible financing options for multifamily investors, history reminds us to proceed cautiously when lending deregulation takes hold.

- Environmental Standards: Energy efficiency mandates and green development incentives may see rollbacks. For regions like the Pacific Northwest, which often lead on sustainability, this could create opportunities to differentiate our properties by staying ahead of federal trends.

Tax Policy: Adjustments on the Horizon

- SALT Deduction Reinstatement: High-tax states like California and Oregon could benefit from the reinstatement of full State and Local Tax (SALT) deductions. This change could increase after-tax returns for investors and bring new liquidity to markets that have struggled under previous caps. I was somewhat surprised (and pleased) to hear that this was being contemplated, given the previous Trump Administration was responsible for the cap in the first place. Some more commentary here.

- 1031 Exchange Modifications: Subtle but impactful changes to 1031 exchange rules are anticipated, potentially expanding the definition of like-kind exchanges. For sophisticated investors, this could provide greater flexibility to optimize portfolios dynamically.

- Opportunity Zones: Expect a renewed focus on Opportunity Zone investments, with expanded geographic definitions and enhanced tax incentives. For regions with emerging economic corridors, this could unlock significant investment opportunities.

These changes represent a supply-side approach that encourages private sector investment rather than direct government intervention, which we would generally view as positive.

Multifamily Specific Changes

- Potential Tax Credits for New Multifamily Construction: Early signals suggest we could see incentives aimed at spurring new development to address housing shortages. For investors, this could translate to stronger returns on ground-up projects or major renovations, particularly in underserved markets.

- Changes in Depreciation Schedule Interpretations: Adjustments to depreciation rules may create opportunities to accelerate write-offs, improving cash flow for property owners. While the specifics remain to be seen, even modest changes here can significantly impact after-tax yields in multifamily investments.

- Reduction of Regulatory Barriers to Development: The Trump administration’s likely push for deregulation could make the development process faster and more cost-efficient. Easing zoning restrictions or simplifying permitting processes would lower barriers to entry and increase the feasibility of multifamily projects in traditionally challenging markets.

Closing Note: The Tariff Question

As we look ahead, one key area of uncertainty is the potential impact of new tariffs under the Trump administration. Tariffs often raise costs for imported goods, which could cascade into higher prices for consumers and businesses, fueling inflation. Industries reliant on global supply chains, such as construction and manufacturing, may see cost pressures that affect everything from building materials to operational expenses, potentially challenging real estate developers and investors alike.

However, the impact isn’t guaranteed to be inflationary or harmful. If tariffs are strategically targeted and paired with domestic production incentives, they could stimulate investment in U.S. industries, boost job creation, and strengthen supply chain resilience. Moreover, global markets have shown an ability to adapt, with companies finding alternative suppliers or absorbing costs to remain competitive. In a balanced economy with moderating inflation trends, these effects might offset or even negate the inflationary risks. Additionally, it’s not yet clear whether the current tariff saber-rattling represents a genuine policy direction or a negotiation tactic to pressure partners and adversaries into concessions beneficial to the United States. What we do know from Trump Administration 1.0 is that tariffs were used extensively, though any inflationary effects were largely masked by the onset of the COVID-19 pandemic. While history shows tariffs may be deployed again, it doesn’t yet offer a definitive answer on whether their overall impact will be damaging or helpful this time around.

In Closing

Despite the heavy and frightening rhetoric on both sides, the US Government is likely to function as it often does - slowly and ineffectively. The changes a Republican Administration will bring will mostly center around a market focused approach to improving housing, and a decrease of regulation, which we would anticipate to be positive, overall, for the market.

On the other hand, while we also would contemplate lending standards loosening as regulation loosens, this isn’t always a good thing in the long run. We will continue to look for fundamentally sound investments for our clients that can weather the long term.

Interesting Reads This Month

- Homebuyers Enter a Strange New World

- St. James Place to sell 2 Billion Pounds of Commercial Assets

- Real Estate Scions Breaking the Cardinal Rule

- Fed’s Williams Sees Inflation Falling

- Inflation Heading in the Wrong Direction

If you are an accredited investor and curious to explore our upcoming investment opportunities, please touch base here.